So, you’re interested in financial translation? That’s fantastic! Financial translation is a highly specialized field that requires a unique blend of language skills and financial knowledge.

But don’t worry, even if you’re just starting out, with the right guidance and practice, you can become a successful financial translator.

Financial translation involves translating financial documents such as annual reports, balance sheets, income statements, and legal contracts. It requires a high level of accuracy, precision, and cultural sensitivity.

In this article, we’ll explore the challenges, skills, and best practices as well as essential concepts and terminology you need to know to get started as a financial translator.

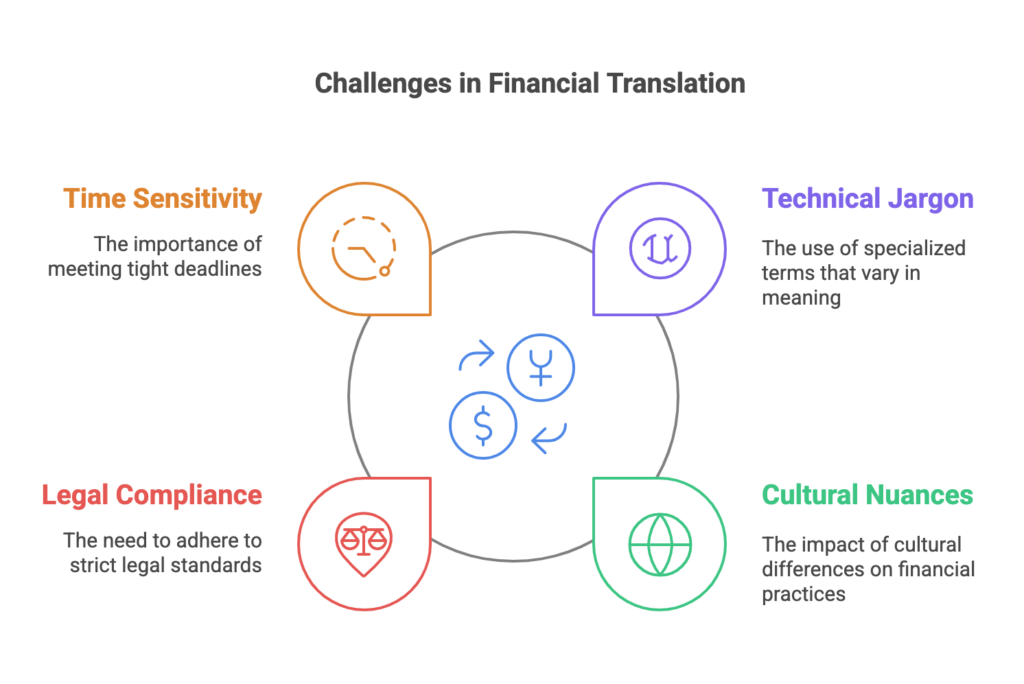

The Challenges of Financial Translation

Translating financial documents is trickier than it sounds. Here’s why:

- Lots of Weird Words: The financial world is rife with technical jargon and industry-specific terms that can be difficult to translate accurately. A single word can have multiple meanings depending on the context.

- Cultural Nuances: Financial practices and conventions vary across cultures. How people handle money and business changes from country to country. A direct translation might not make sense to someone from a different culture.

- Rules & Regulations: Financial documents often have strict legal and regulatory requirements. Translators must ensure that their work adheres to these standards to avoid legal repercussions.

- Time Sensitivity: The financial industry is fast-paced, and deadlines are often tight. Financial translators must be able to deliver accurate and timely translations to meet client needs.

The Importance of Accurate Financial Translations

Getting financial documents translated correctly is really important. Here’s why:

- It’s Crucial for Investors in Making Decisions: Accurate financial translations help investors make informed decisions. When people invest money, they need to understand what they’re buying. Accurate translations help them make good choices.

- Mergers and Acquisitions: When companies from different countries merge or buy each other, they need to understand each other’s finances. Correct translations make this possible.

- Regulatory Compliance: Companies that deal with money have to follow specific rules. Accurate translations help them stay out of trouble.

- Risk Management: Misunderstanding financial documents can lead to big problems. Correct translations help prevent this.

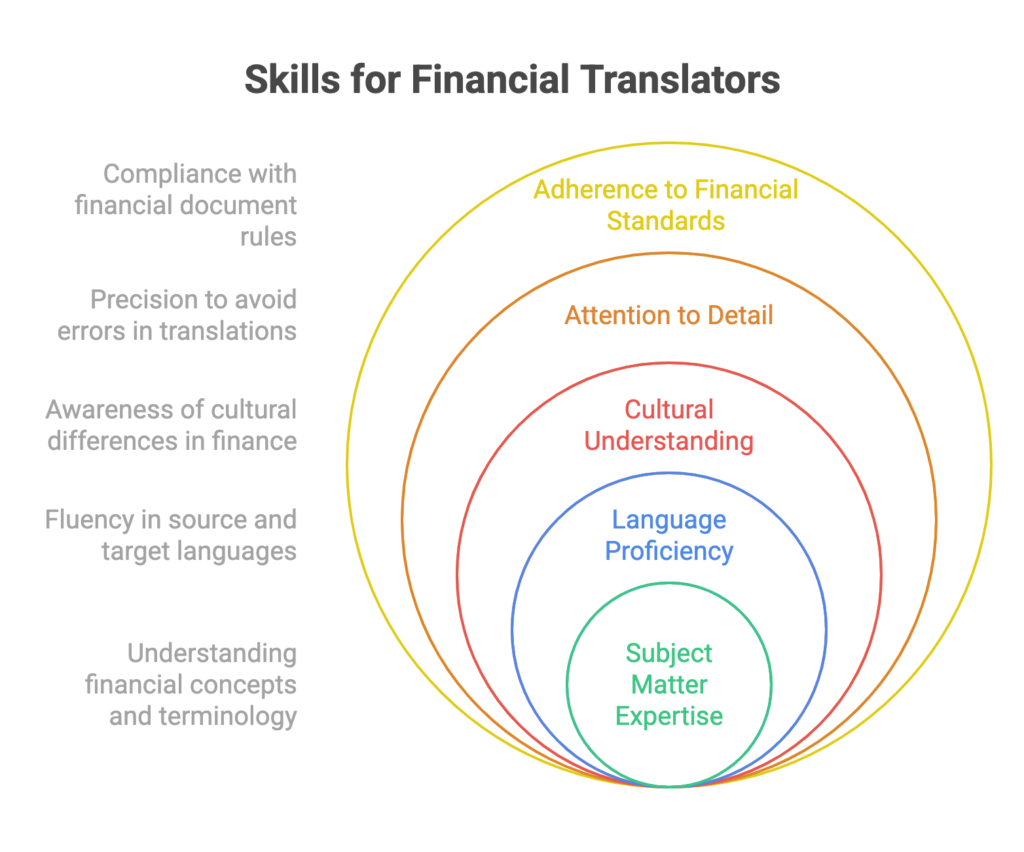

What Makes a Good Financial Translator?

To be a great financial translator, you need:

- Subject Matter Expertise: Financial translators should have a strong understanding of financial concepts and terminology. You need to understand money, business, and how they work.

- Language Proficiency: Fluency in both the source and target languages is essential. This is basic. You need to be really good at both languages, the one you’re translating from and the one you’re translating to.

- Cultural Understanding: Understanding cultural differences in financial practices and terminology is crucial. People do business differently in different countries. You need to understand these differences.

- Attention to Detail: Financial translations require meticulous attention to detail to avoid errors. Little mistakes in financial documents can cause big problems. You need to be super careful.

- Adherence to Financial Standards: There are specific rules for financial documents. You need to make sure your translations follow the relevant rules.

- Proofreading and Quality Control: To ensure accuracy, you need to carefully review the translations to find and fix any mistakes.

Key Skills for Financial Translators

To excel in financial translation, professionals must possess a unique blend of linguistic and financial expertise:

- Linguistic Proficiency: A deep understanding of both source and target languages is essential to convey meaning accurately.

- Financial Acumen: A strong grasp of financial concepts, accounting principles, and economic theories is crucial to ensure precise translations.

- Cultural Sensitivity: Recognizing and respecting cultural nuances is vital to avoid misunderstandings and misinterpretations.

- Meticulous Attention to Detail: Financial translations demand accuracy and precision. Every word and number must be correct.

- Adaptability and Continuous Learning: The financial industry is constantly evolving. Successful translators must stay updated on industry trends, regulations, and emerging technologies.

Understanding the Basics of Finance

Financial Statements

Think of financial statements as a company’s report card. They show how a company is doing financially.

- Income Statement: This shows how much money a company has earned and spent over a certain period. It’s like a report card for a class.

- Balance Sheet: This shows a company’s financial health at a specific moment in time. It’s like a snapshot of a company’s assets (what it owns) and liabilities (what it owes).

- Cash Flow Statement: This shows how much cash is flowing in and out of a company. It’s like a budget for a company.

Key Financial Ratios

These are like measurements that help us understand a company’s performance.

- Profit Margin: This shows how much profit a company makes for every dollar of sales.

- Return on Investment (ROI): This shows how much profit a company makes compared to the amount of money invested.

- Debt-to-Equity Ratio: This shows how much a company relies on debt compared to equity (ownership).

Accounting Standards

These are the rules that companies follow when preparing their financial statements.

- GAAP (Generally Accepted Accounting Principles): These are the accounting standards used in the United States.

- IFRS (International Financial Reporting Standards): These are the accounting standards used by most countries outside the United States.

Economic Indicators

These are numbers that help us understand the overall health of an economy.

- GDP (Gross Domestic Product): This measures the total value of goods and services produced in a country.

- Inflation: This measures the rate at which prices are rising.

- Unemployment Rate: This measures the percentage of people who are unemployed and looking for work.

Key Terminology in Financial Translation

Let’s break down some of the key terms you might encounter in financial translation:

Common Financial Terms and Their Nuances

- Profit and Loss: This is a basic term, but its translation can vary depending on the context and the specific language. For instance, in some languages, there might be different terms for operational profit, gross profit, and net profit.

- Asset and Liability: These terms are fundamental to accounting. However, their precise meanings can differ across cultures. For example, in some cultures, certain assets might be considered liabilities under specific circumstances.

Industry-Specific Jargon

- Banking: Terms like “mortgage,” “loan,” and “interest rate” can have different nuances and implications in different countries.

- Insurance: Terms like “premium,” “policy,” and “claim” might have cultural and legal variations.

- Investment Banking: Terms like “IPO,” “merger,” and “acquisition” can have complex legal and financial implications that need to be accurately conveyed.

Currency Exchange Rates and Foreign Exchange Markets

- Exchange Rate: The rate at which one currency can be exchanged for another. Fluctuations in exchange rates can significantly impact international transactions.

- Forex Market: This is a global marketplace where currencies are traded. Understanding the dynamics of the forex market is crucial for financial translation.

Legal and Regulatory Terms

- Tax Laws: Tax laws vary widely across countries, and translators must be aware of these differences to ensure accurate translations.

- Securities Regulations: Regulations governing the issuance and trading of securities can be complex and vary from country to country.

- Contract Law: Contracts, especially international contracts, involve legal terms and conditions that must be translated accurately.

Cultural Nuances in Financial Translation

Cultural differences can significantly impact financial practices and terminology. It’s essential for financial translators to be aware of these nuances to ensure accurate and culturally appropriate translations.

- Accounting Standards: Different countries have different accounting standards, such as GAAP (Generally Accepted Accounting Principles) in the US and IFRS (International Financial Reporting Standards) 1 used globally.

- Business Etiquette: Cultural norms for business interactions, such as gift-giving, negotiation styles, and levels of formality, can vary greatly.

- Financial Attitudes: Attitudes towards debt, risk, and investment can differ significantly across cultures. For example, some cultures may prioritize saving and long-term investments, while others may be more inclined to borrow and spend.

- Local Customs and Practices: Certain financial practices, such as tipping, gift-giving, and negotiating, may vary significantly from one culture to another.

- Idioms and Slang: Many languages have idioms and slang terms related to money and finance that may not have direct translations.

The Importance of Cultural Sensitivity in Financial Translation

Cultural sensitivity is crucial in financial translation to avoid misunderstandings and misinterpretations. By understanding cultural nuances, translators can:

- Ensure Accuracy: Accurately convey the intended meaning of financial documents, avoiding any potential misunderstandings.

- Maintain Clarity: Use clear and concise language that is appropriate for the target audience.

- Respect Cultural Differences: Adapt translations to the specific cultural context, taking into account local customs, values, and beliefs.

- Build Trust: Demonstrate respect for the target culture and build trust with clients and stakeholders.

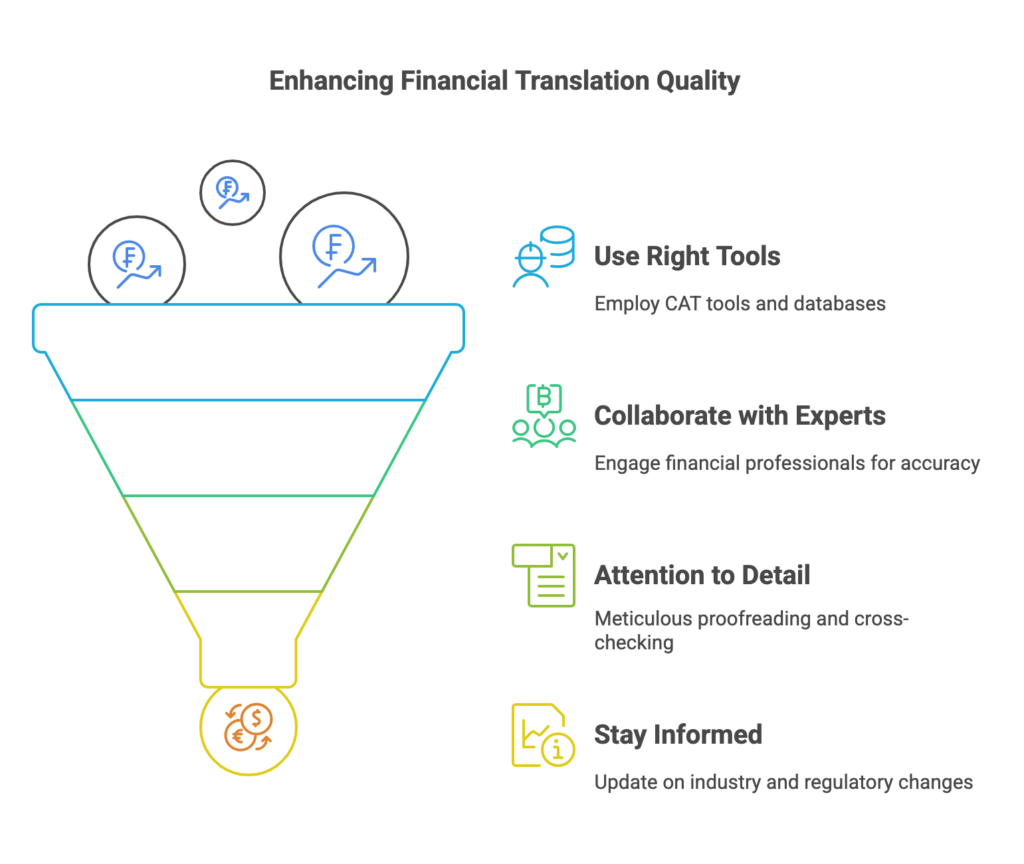

Best Practices for Financial Translators

To ensure the highest quality financial translations, consider these best practices:

- Use the Right Tools

- CAT Tools: These tools can help you translate faster and more accurately by suggesting translations, creating translation memories, and managing terminology.

- Translation Memories: These store previously translated segments, saving time and ensuring consistency.

- Terminology Databases: These help you maintain consistency in your translations, especially when dealing with complex financial terms.

- Team Up with Financial Experts:

Consult with accountants, economists, or financial analysts to clarify complex concepts and ensure accuracy. - Pay Attention to Detail

- Proofread Carefully: Check your work meticulously to identify and correct errors in grammar, punctuation, and spelling.

- Cross-Check: Verify the accuracy of figures, dates, and references.

- Consult Style Guides: Follow specific style guides, such as the Chicago Manual of Style, to ensure consistency and clarity.

- Stay Up-to-Date

- Industry News: Keep up with the latest developments in finance, economics, and accounting.

- Regulatory Changes: Stay informed about changes in regulations and standards.

- Technology Trends: Explore new tools and technologies that can improve your efficiency and accuracy.

The Future of Financial Translation

As technology continues to evolve, so too does the landscape of financial translation. Here are some key trends shaping the future of this specialized field:

- AI and Machine Translation: A Helpful Tool, Not a Replacement

AI is getting smarter, and it’s starting to help with translations. Machines can quickly translate large amounts of text. However, they often miss the nuances and cultural subtleties that human translators can easily spot. So, while AI can be a helpful tool, it’s unlikely to replace human translators anytime soon. - Working Remotely: A Global Workplace

More and more financial translators are working remotely. This means they can work with clients from all over the world, without being tied to a specific location. This flexibility is great for both translators and clients. - Ethics in the Digital Age

As technology advances, it’s important to remember that financial information is highly sensitive. Translators must always protect client data and follow ethical guidelines. This includes: - Data Privacy: Keeping client information confidential.

- Security: Protecting documents from unauthorized access.

- Intellectual Property: Respecting copyright laws and avoiding plagiarism.

Conclusion

Financial translation is a demanding yet rewarding field. Master the intricacies of finance, language, and culture, translators so that you can facilitate global business and investment by bridging linguistic and cultural gaps. As the world becomes increasingly interconnected, the need for skilled financial translators will only continue to grow.